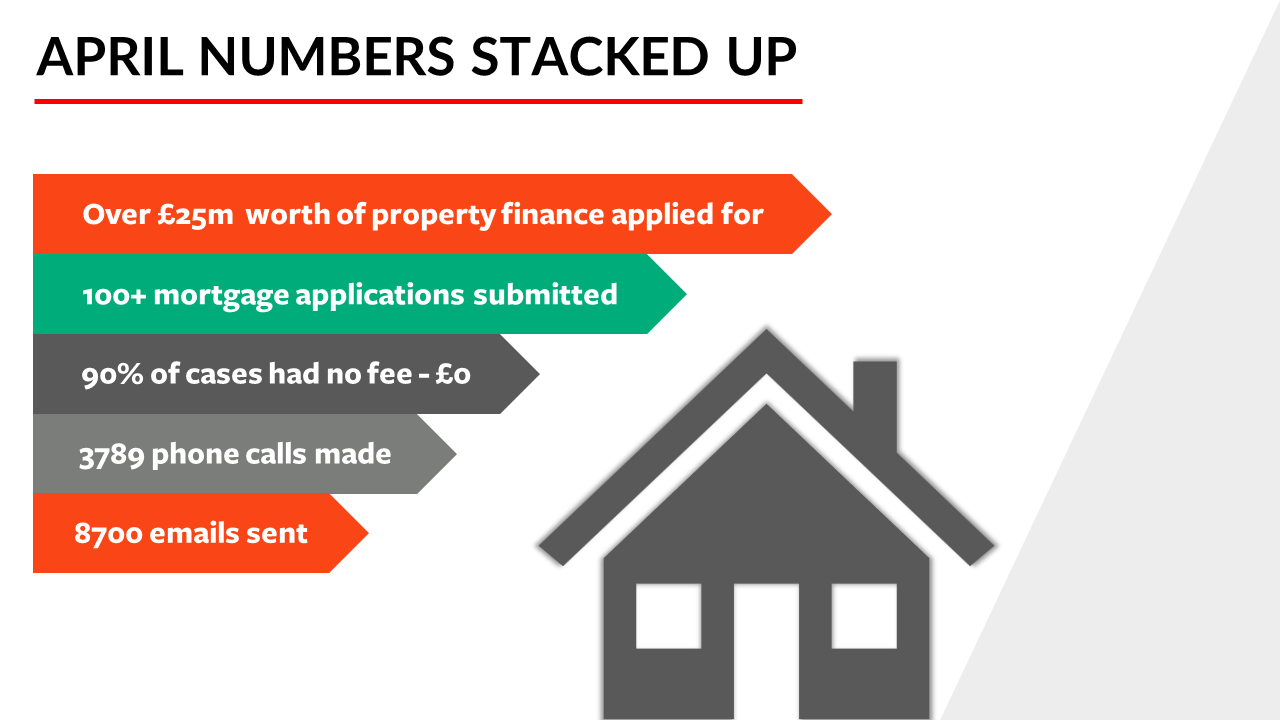

How our April mortgage numbers stacked up

The last few months have certainly been newsworthy for us all. From the war in Ukraine and the ripple effect this has sent across the world, to the cost-of-living crisis, all of us have been affected.

Most recently the Bank of England raised the Base Rate to 1%. The long-term effects this will have on the housing market can only be speculated, but in the short term we have already seen mortgage products withdrawn and rates rising from the majority of lenders.

Despite all of the concerning developments taking place, we are continuing to see from our clients a resilience to carry on with plans to invest in property, many of whom intend on expanding their portfolios in the coming months.

We have decided that now would be a great time to take a closer look at some of our business statistics and share this with our readers.

April saw our team submit over £25 million worth of mortgage applications comprised of 100+ cases.

We had a mixture of Buy-to-Lets, Commercial Finance, HMOs and a number of Residential Mortgages. Applications were in the majority ‘new purchases’ which is certainly encouraging.

Approximately 90% of these cases were completed with no broker fee - £0, so our clients only had to consider any associated lender fees.

Our team made close to 3800 calls, and sent 8700 emails to clients, lenders, and solicitors to support applications.

Get a Mortgage Quote

Advice that’s tailored to your own bespoke situation.

Enter your contact details and we’ll contact you back within 1 hour (during normal business hours).

No Broker Fee*

Let Vincent Burch Mortgage Services arrange the best mortgage available for your circumstances.

To request a phone call from one of our advisors, please submit your details above and we will contact you at the earliest possible time.